By Pierrick Clerc and Eric Monnet

This post is part of the HISRECO 2018 series. Participants of the 2018 HISRECO conference were asked to write short blogposts to highlight their contribution to the conference for a general audience. The idea of this blogged conference comes from the « Learning by the book » conference in Princeton, published as a series on the History of Knowledge Blog. This post is number 6 of 7.

Bridging the gap between history of economics and history of economic thought is an important venture. It requires considering economic knowledge produced outside academia, in governments, international institutions and central banks. This leads us to explore what sociologists of science call the “boundaries of science”, and to investigate the relationship between academic and non-academic publications. Even in countries with a strong postwar academic community of economists like the US, policy institutions produced economic thinking which was integrated into policy discourses, public or parliamentary debates and, sometimes, then, in academia. We are especially interested in the period when central banks did not have a proper research department (when central bank economists did not publish in academic journals).

During the postwar period, we know at least three examples of economic doctrine shaped by economists in central banks and which eventually had a strong influence on national academic debates: the 1959 Radcliffe Report in England, the Économie d’endettement in France in the 1970s, and the “Availability Doctrine” in the United States in the 1940s-1950s. These doctrines were based on the work of central banks economists attempting to build their own theory so as to describe monetary policy implementation and formulate guidance for policymakers. They criticized mainstream monetary theory of their time for being too abstract and undocumented about the true process of money creation. They also blamed its incapacity to account for institutional differences in financial systems and monetary policy operations across countries. Most of these works were published in reports or documents rather than scientific journals. They however gained recognition in academia, by being reviewed and discussed by economists in scientific journals, textbooks and included in course syllabuses.

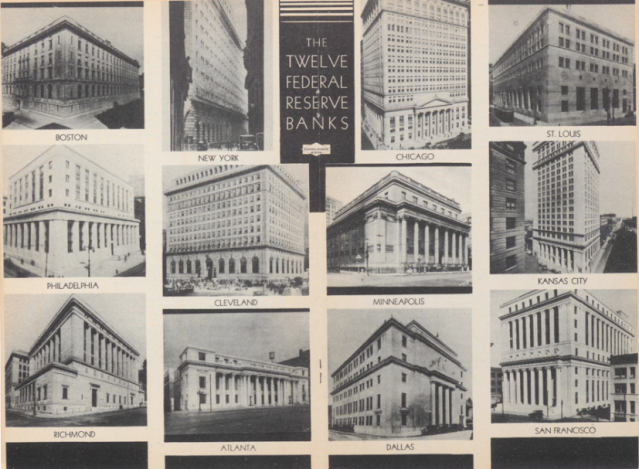

Our research focuses on the Availability Doctrine, which was notably developed by Robert Roosa at the New York Federal Reserve in the late 1940s. Roosa was Acting Manager of the Research Department and then Vice President of the Research Department when he left this institution in 1961. The Availability Doctrine gained wide recognition in academia in the early 1950s, particularly through hearings at the US Congress (on credit controls and monetary policy) where it was debated. The published Congress hearings were considered as such an important piece of economic discourse that they were reviewed by James Tobin in the Review of Economics and Statistics. The Availability Doctrine was a narrow theory about monetary policy implementation but—as recognized by Jaffee and Stiglitz (1990)—eventually gave birth to the now standard theory of credit rationing which emerged in the 1960 and 1970s.

The distinctive feature of the Availability Doctrine is the change in emphasis, on the loanable funds market, from borrowers’ to lenders’ behavior. Its proponents argued that, due to changing institutional structures on this market and the large holding of public debt by banks after the war, lenders became strongly sensitive to variations in the yields on government securities. Therefore, contrary to a widespread belief at that time, monetary policy would have important effects on aggregate demand: even if the demand for funds were quite interest inelastic, monetary policy would nevertheless operate through the large response of the amount of funds made available by lenders to movements in yields on government securities.

The main message of the Availability doctrine was that quantities (rationing of bank assets) were much more important than prices (interest rates) for the transmission of monetary policy. Hence the term “availability” denoted the emphasis on “quantities”. It went against standard theories which focused on the money base or interest rates. It also reasoned with the main concerns of policymakers at that times, that is the interaction between monetary policy and public debt management.

The Availability Doctrine cannot be understood without the institutional and historical context of postwar monetary policy (which notably had to deal with a massive amount of government securities in bank balance sheets). This doctrine was not supposed to be a general and full fledge theory that could be applied in all situations. Instead, it was very context-specific and recognized as such. Moreover, even though its theoretical foundations were weak, the Availability Doctrine played a key role in showing the limits of mainstream academic models and in formulating new areas for research. As such, the historical study of the Availability Doctrine we aim to provide here is not only interesting for historians of monetary policy in the US. It is also an important, but underestimated, milestone of postwar economic thought. It also shows the limits of the usual interpretation of postwar monetary thinking as a mere fight between monetarists and Keynesians. The Availability doctrine, as other central bank’ doctrines, cannot be understood on the basis of these usual categories (Monnet 2018).

Why the economists of the New York Federal Reserve developed the Availability Doctrine? We particularly stress two reasons. First, the perceived weaknesses of the leading monetary theories in the 1940s and 1950s (mentioned in the second paragraph) as well as the evolution in the practice of central banking that occurred at that time in the US. Secondly, economists of the US central bank were looking at the experience of credit controls in European countries as a way to renew their thinking about the transmission of credit and monetary policy.

In the 19th century, most (leading) economists occupied a position within the national administration or took part in policymaking decisions. As a result, they were in close contact with actual economic issues. After 1945, economist became a profession in its own right. Hence, institutions such as central banks played a key role of intermediary between economists and policymakers. In times of major negotiated reforms of the international monetary system (Bretton Woods), central banks were also immediately exposed to the influence—if not of foreign economic thinking—of the diversity of monetary experiences and institutions in the Western world.

What were the relationships between the Availability Doctrine and academic research? We first discuss how this doctrine became legitimate among academic circles in the 1950s. We believe it was the case since the Availability Doctrine was elaborated within an important central bank. Then, we detail the successive steps which led the Doctrine to gain recognition in this world, from the hearings of the Patman commission to the famous survey of Harry Johnson in 1962. We notably show that its increasing recognition was far from being linear, in particular because of its lack of theoretical underpinnings.

Looking further at the evolution of the Availability doctrine and its differences with the other monetary theories, we argue that the Doctrine was accepted by economists since it proposed a theory for which monetary policy affected aggregate demand independently from any interest rate mechanism. Therefore, both monetarists (who insisted on the quantity of money) and Keynesians (most of whom considering that aggregate demand was interest inelastic) could adhere to this doctrine.

Although the Availability Doctrine was an important stone in the garden of US policy and monetary debates of the 1950s and 1960s, it is now mostly—if not only—known among economists as an early root of the microeconomic literature on credit rationing, far from the technicalities of postwar monetary policy implementation and lively economic debates at the US Congress. We hope that our contribution will bring some historical background on the emergence of this literature for the economists working in the monetary field.

Pierrick Clerc is lecturer at Sciences Po Paris and Paris Sciences & Lettres. He is also research associate at IRES-UCLouvain.

Eric Monnet is senior research economist at Banque de France. He is also affiliate member at Paris School of Economics and research affiliate at the CEPR. He tweets @MonnetEric.